Link Payment

Easy and secure online payments via link without need of webshop or API integration

This page outlines the basics of using Link Payment functionality in Netaxept.

Definition

If you don't have a payment solution in your webshop, or even if you have no website, your customers can still pay online without you having to make a payment integration in your systems. This is possible by using Netaxept's Link Payment functionality. Link Payment can, of course, be used also as an addition to your webshop integration.

With Link Payment, your customers can pay their purchases via payment links created by you.

- The link can be created in Netaxept Admin or via API if you have done an API integration towards Netaxept.

- In both cases, after creating a link you may send it out to your customer for example together with an offer, order confirmation or invoice by email, SMS or by other text media.

- When the customer clicks the link, a web browser will open, being on a desktop / laptop, on a tablet or on a mobile phone.

- Browser redirects the customer to the secure payment window offered by Netaxept for filling in their payment method information to complete the payment.

Use cases

Link Payment is ideal for merchants that for example

- Want to sell remotely, such as agree on a sale over phone or email and get certainty of the payment online.

- Sell customised deliveries such as tailored clothes or flower installations where they want to reserve the money before starting to work on the product/service as it cannot be resold if the customer doesn't pick it up.

- Get a reservation guarantee in advance for example a fee for booking a restaurant table at a busy night.

- Use it as an alternative for sending invoices; the order confirmation of sold product/service along with the payment link can simply be mailed out.

Prerequisites for the usage

To be able to utilize Link Payment, you need to sign agreement for Netaxept. Beside this, an eCommerce acquiring agreement is required. Link Payment is considered as a card-not-present solution where the merchant abides to the standard rules of eCommerce deliveries.

Link Payment is mainly used for card payment transactions. However, most, but not all, payment methods available in Netaxept are supported also via Link Payment. If you wish to perform link payment transactions also by using other payment methods than cards, you need to sign agreements with the payment method providers whose payment methods you wish to receive. Besides this, you need to activate the payment methods in question by adding the corresponding credentials in to Netaxept Admin’s "Options" => "Agreement" tab. The merchant is responsible for ensuring that all information entered is correct.

Before starting to create payment links, check that transaction timeout is disabled in Netaxept Admin’s "Options" => "Callback" tab. If transaction timeout functionality is in use, the link doesn't work and payment cannot be processed after the timeout value has exceeded.

Performing Link Payment via Netaxept Admin

Log in to Netaxept Admin

Log in to Netaxept Admin:

- Production: https://epayment.nets.eu/admin

- Test: https://test.epayment.nets.eu/admin

Generate payment link

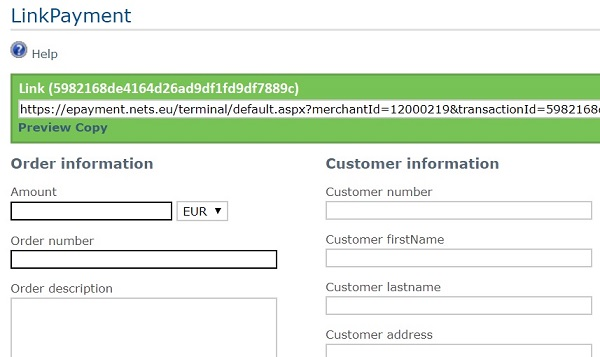

When having logged in to Netaxept Admin, go to "Help and Tools" => "Tools" and select "Link Payment". In the Link Payment page, fill in at least the mandatory fields. Amount, currency, order number and order description are shown to the customer in the payment window.

- Amount: Required. The amount to be authorized or authorized and captured in the specified currency. Use a comma as a separator, for example €1,20 = 1 euro and 20 cents.

- Currency: Required. The currency code for the transaction amount.

- Order number: Required. A transaction identifier defined by the merchant. Nets recommends generating each transaction a unique order number since it helps you to keep track of the individual payment. However, if wanted the same order number can be used several times. Digits and letters are allowed except special characters, empty spaces and scandinavian letters like Æ Ø Å Ä Ö.

- Order description: Optional. Free-format data content determined by the merchant and displayed to the customer on the payment window.

- Transaction recon reference: Optional. A reference number allocated to the transaction by the merchant. The transaction reference number will be displayed in Netaxept Admin for the merchant and it will be returned to the merchant with the settlement if the chosen acquirer supports the return of the transaction-specific reference number. The transaction reference number can also be seen in the merchant's bank statement when direct bank payments are in question.

- Language: Required. Language that is used on the payment window for the customer.

- Auth / Sale: Required. Operation to be done automatically for the transaction after the customer has completed the payment window. According to card acquirers, payment must not be captured until the product or service has been delivered to the customer or there is certainty regarding its delivery. In between, you have the right to reserve the amount on the customer's account. It means that the operation SALE is only allowed if you sell services or products with immediate delivery. If you cannot deliver immediately, please don't use SALE operation, but instead use AUTH for reserving the money for the time being and later execute the capture in Netaxept Admin or via API.

- Auth = Transaction will be only authorized

- Sale = Transaction will be both authorized and captured

- Customer information: Optional (required e.g. if direct banks via Paytrail). Customer information identifies the customer and is shown in Netaxept Admin for the merchant.

After you have filled in all the needed information, create a payment link by clicking "Create link". The payment link will be presented to you at the top of the page in a green field. By clicking "Copy" you can copy the link to your computer’s clipboard for pasting it, for example, to an email that you are going to send to your customer.

If you want to preview the payment window before sending the link, click "Preview" and you'll be displayed the payment window as the customer will see it.

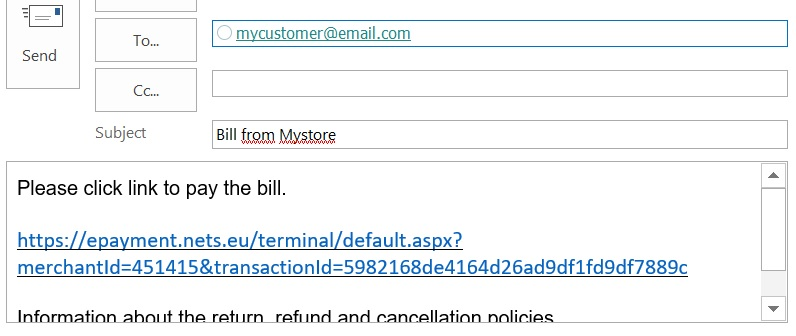

Send payment link to customer

Even though you send the payment link by email, SMS or by other means, instead of setting up a complete integration, take your time to present it properly. Remind the customer why you are sending them a link asking for their money, use a spellcheck to make sure that you are sending out well formatted and credible email or SMS. If you don't, your customer may mistrust your communication or spam filters can pick up the message, having it never reach the customer.

Also, when using Link Payment, remember to inform your return, refund and cancellation policies clearly to the customer in the email or similar that contains the link or by other means.

Wait for customer to complete payment

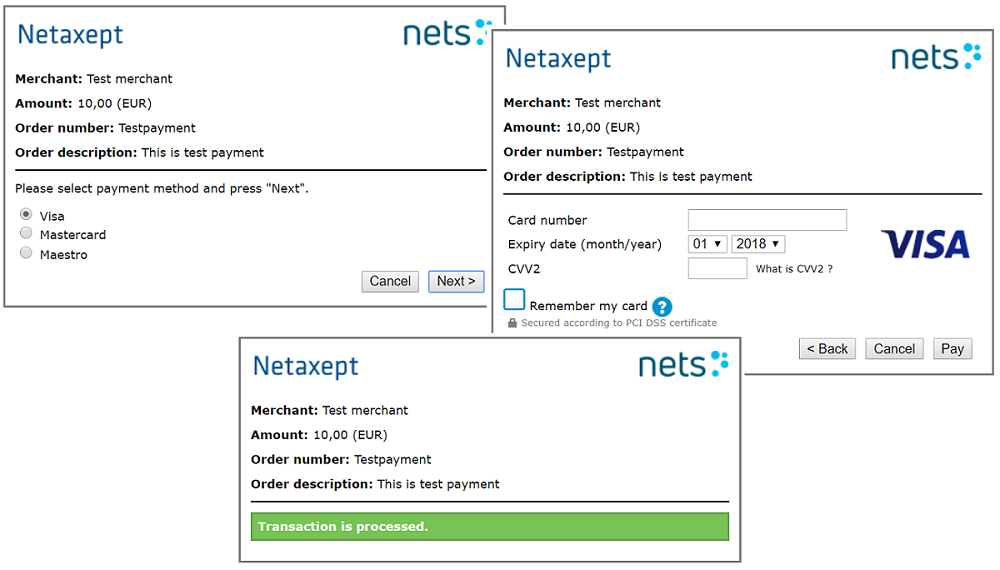

When customer clicks the link, they are redirected to the payment window hosted by Netaxept for entering payment method information. The merchant can customize this payment window with colours and merchant logo. This needs to be done before creating a link in the Netaxept Admin's "Options" section.

If the payment fails when the customer is in the payment window and the customer informs you about the failure, it is recommended to create a new link and send it to the customer.

Check incoming payments

The transaction will be available in Netaxept Admin's "Transactions" tab as soon as the customer has completed the payment. For each transaction, you will see information about card type, date and time of when the transaction was completed by the customer, order number and amount you specified for the payment, and the status of the transaction. Captured payments are highlighted with a green bar and payments that are only authorized, are marked as grey bar.

Depending on the status of the transaction, you can either capture or credit the money or cancel the authorization. To do this, click on a line in the table, to see the full details about the transaction, and then click the "Financial operations". Captures and credits can be done up to what's available for the transaction. Also, partial amounts can be captured and credited.

Performing Link Payment via API

Instead of using Netaxept Admin for generating payment links, you can also generate these links automatically through Netaxept API, as would done in a regular webshop. The difference here is that instead of coming from a checkout page in a webshop, the customer would be directed to the payment window by clicking the link in an email or SMS sent by you. When Link Payment is used this way, API integration towards Netaxept is required.

Generate payment link

Implement the technical API in accordance with Netaxept's API instructions. Include either autoAuth=true or autoSale=true in the Register call, and send the Register call to Netaxept. The REST API messages must be sent to an address starting with

- Production: https://epayment.nets.eu

- Test: https://test.epayment.nets.eu

Based on the Register response, formulate the payment link to be sent to the customer. The link needs to include the Terminal call starting with

- Production: https://epayment.nets.eu/Terminal/default.aspx

- Production (mobile): https://epayment.nets.eu/terminal/mobile/default.aspx

- Test: https://test.epayment.nets.eu/Terminal/default.aspx

- Test (mobile): https://test.epayment.nets.eu/terminal/mobile/default.aspx

Also, the payment link needs to include your Merchant ID provided by Nets and the unique Transaction ID for each payment. You will receive this Transaction ID from the Register response received in the previous step. Below you can find an example of the link that is ready to be sent to the customer.

Production: https://epayment.nets.eu/Terminal/default.aspx?merchantId=[MERCHANTID]&transactionId=[TRANSACTIONID] Test: https://test.epayment.nets.eu/Terminal/default.aspx?merchantId=[MERCHANTID]&transactionId=[TRANSACTIONID]

After you have sent the payment link to your customer and the customer has completed the payment in the payment window, you can further process the transaction either in Netaxept Admin, as described earlier, or via API.