Direct bank payments

Enable customers to pay from their bank accounts with familiar banking credentials

This page outlines the basics of using direct bank payments via Netaxept and gives you instructions needed for a fluent implementation.

Use for the end-customer

If the customer decides to pay with direct payment, they are directed from the merchant’s site to their chosen online bank. The direction is done either directly or via Netaxept's payment window, depending on the merchant's technical API implementation towards Netaxept. In the online banking site, the customer is guided through the payment process and after finishing it in the bank’s site, the customer will be redirected to the redirectURL specified by the merchant in the Register call, with a response code "OK", "Cancel", "Reject" or some other bank-specific response code. If the merchant has signed a direct agreement with the bank, the bank will transfer the sum of the payment from the customer's bank account to the merchant's bank account in almost real time.

Activation

To be able to use direct banks in your webshop, you need to sign an agreement with each particular bank you want to use. After the bank has processed your agreement, they will provide you credentials which you need to enter to Netaxept Admin to activate the payment method in question. The merchant is responsible for activating these payment methods in Netaxept Admin and ensuring that all information entered is correct.

- Log in to Netaxept Admin (test: https://test.epayment.nets.eu/admin or production: https://epayment.nets.eu/admin)

- Go to "Options" => "Agreement" tab.

- Choose the correct direct bank from the drop down list and click "Add" button.

- Choose the correct currency and enter credentials. The number of credentials varies between different banks, and the terminology varies as well.

- Save your changes by clicking "Add" button.

Performing API integration

Implement the technical API in accordance with the standard Netaxept's API instructions. Read more about API

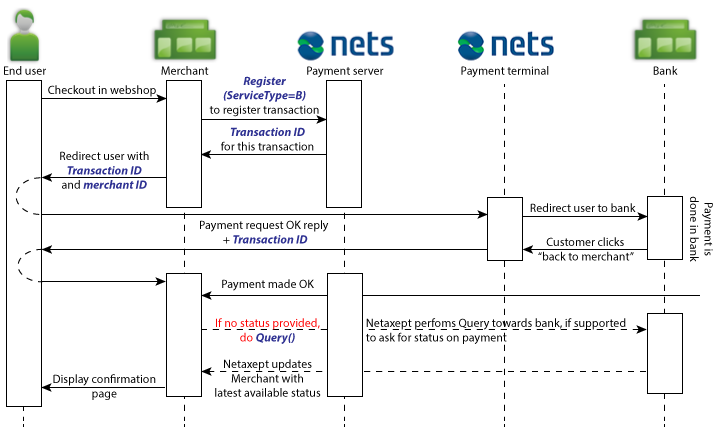

Transaction flow

Start the payment process by sending the information required for the payment to Netaxept by means of the Register call. If you already have a regular card integration implemented, and you have made direct agreements with the banks, there is no need to send any additional parameters along the Register call to Netaxept to make direct banks available for customers. If you are implementing direct banks via Paytrail, then some additional parameters are needed. Also, if you are sending "Payment method action list" parameter along the Register call, you need to add the valid direct bank names into this parameter.

It should be noted that one bank agreement supports only one specific currency. It means that the currency that is sent along the Register call needs to match the currency used when activating the direct bank in Netaxept Admin. For example, if currency "EUR" is sent along the Register call, Swedish direct banks will not appear in the payment window because they require "SEK" to be registered as currency in Netaxept Admin and sent along the Register call.

After the successful Register call, perform the Terminal call to send the customer either to the Netaxept payment window or directly to the online banking site for the payment. After the Terminal phase, Netaxept triggers AutoSale for the transaction, therefore, you don’t need to run AUTH, CAPTURE or SALE on direct bank transactions. This eliminates a step in the standard payment process done via Netaxept and to make sure your setup doesn't try to run these operations, there is a need to check if the payment was made with direct bank as a payment method. This can be done in two ways:

- Use the "Payment method action list" parameter in the Register call to separate direct banks from card and other payments in the checkout phase.

- Perform the Query call after the Terminal phase to see which payment method was used for the payment.

Callback and Query

In order to verify that the transaction has the correct status and the payment has processed successfully and is fully paid, or if you are unsure which payment method the customer used for the payment, we recommend you to implement the Callback function and the Query call as part of the payment process. Through the Callback, you will receive a transaction ID whenever the transaction has a new status. Based on this, you can do the Query call to get the new status and detailed information about the transaction. Read more about Callback and Query

Transaction reference number

Transaction reference number is a unique end-to-end reference number for each transaction. For direct bank payments, this value can be seen on your company's bank statement, through Netaxept Admin and in Nets Merchant Portal, and can be used to match direct bank payments received via Netaxept with the information in your own systems. You can specify a unique reference number for each direct bank payment by sending the "TransactionReconRef" parameter and its value along the Register call to Netaxept. The use of transaction-specific reference number is optional but if you want to use it, it needs to be within the rules dictated by the specific bank or otherwise problems with performing or crediting direct bank payments may occur. If not used, Netaxept will automatically generate a valid value for each bank. Read more about transaction reference number

Supported direct banks

Direct banks that are supported by Netaxept at each time are listed below. Also, below you can find information whether the direct bank in question support credit function in Netaxept's production and/or test environments. It should be noted that some banks don’t support credits and/or queries if the merchant doesn't have settlement accounts in these banks. In addition, not all banks support credit function in their test environment although the corresponding function is working in production environment.

| Bank name | Payment method name in API | Supports credit in production | Supports credit in test |

| Swedish banks | |||

| Danske Bank | SwedishBankDanskeBank | No | No |

| | SwedishBankHandelsbanken | Yes | No |

| Nordea | SwedishBankNordea | Yes | Yes |

| Swedbank | SwedishBankSwedbank | Yes | Yes |

| Finnish banks | |||

| Aktia | FinishBankAktia | Yes | No |

| Ålandsbanken | FinishBankAlandsbanken | No | No |

| Handelsbanken | FinishBankHandelsbanken | Yes | Yes |

| Nordea | FinishBankNordea | Yes | No |

| OP Will be discontinued | FinishBankOp | Yes | No |

| OP New API integration | OPBankFinland | Yes | No |

| POP Pankki | FinishBankPopPankki | Yes | Yes |

| Säästöpankki | FinishBankSaastopankki | Yes | Yes |

| Oma Säästöpankki | FinishBankOmaSaastopankki | Yes | No |

| Danske Bank | FinishBankSampo | Yes | Yes |

| S-Pankki | FinishBankSPankki | Yes | No |

| Baltic banks | |||

| Luminor Bank Estonia | EstonianBankLuminor | No | No |

| SEB Estonia | EstonianBankSEB | No | No |

| SEB Latvia | LatvianBankSEB | No | No |

| SEB Lithuania | LithuanianBankSEB | No | No |

| Swedbank Estonia | EstonianBankSwedbank | No | No |

| Swedbank Latvia | LatvianBankSwedbank | No | No |

| Swedbank Lithuania | LithuanianBankSwedbank | No | No |

| DNB Latvia | LatvianBankDnb | No | No |

| DNB Lithuania | LithuanianBankDnb | No | No |

Finnish direct bank payments via Paytrail

Instead of signing bilateral agreements with Finnish banks, i.e. signing agreement directly with each particular Finnish bank, you can implement Finnish direct bank payments via Netaxept also with only one agreement, one API integration and one payout containing all direct bank payments. This service is called Collecting Settlement Service, and it is offered by Paytrail – the Finnish licensed payment institution that provides online payment services to eCommerce merchants and is part of the Nets group. Read more about direct bank payments via Paytrail from the Getting Started Guide

All Finnish direct banks via Paytrail supports credit in production.

Norwegian direct bank payments via BankAxess

If you want to offer your customers the opportunity to pay their online purchases by using Norwegian direct banks and Bank ID, you can implement BankAxess into Netaxept. To get this work, you need to sign a BankAxess agreement with one of the Norwegian banks that support BankAxess as a payment method. After the agreement is processed by your chosen bank, Nets will activate BankAxess so that it is ready for you to implement it.

European direct bank payments via SOFORT

Netaxept also supports SOFORT, an operator that is connected to most banks in Germany, Austria, Switzerland, Belgium, United Kingdom, Netherlands and Italy. If you want to offer your customers the opportunity to pay with these banks' direct bank payments, sign the agreement with SOFORT and activate “SofortBanking” as a payment method in Netaxept Admin. SOFORT supports both partial and full credits in production.